sQuid Microfinance

Building digital communities, enabling financial inclusion

Our approach

We work in partnership with microfinance institutions to digitally optimise their service, helping them move away from manual, paper-based processes. We provide an end-to-end process, or sQuid can be used in modules to address different parts of an existing business model.

In Kenya, we operate our own microfinance service through our iMlango programme, integrating microfinance in the education-focused initiative, which supports marginalised communities. This real-world experience helps us to deliver pragmatic digital solutions.

Digital first microfinance solutions

We provide real-world expertise, amassed over a decade of running our own digital financial services in the UK and Kenya, where we service end-customers. This makes us much more than just a software and technology provider. Our sophisticated platform enables microfinance institutions to accelerate their digital transformation, efficiently execute their digital strategies, and drive financial inclusion.

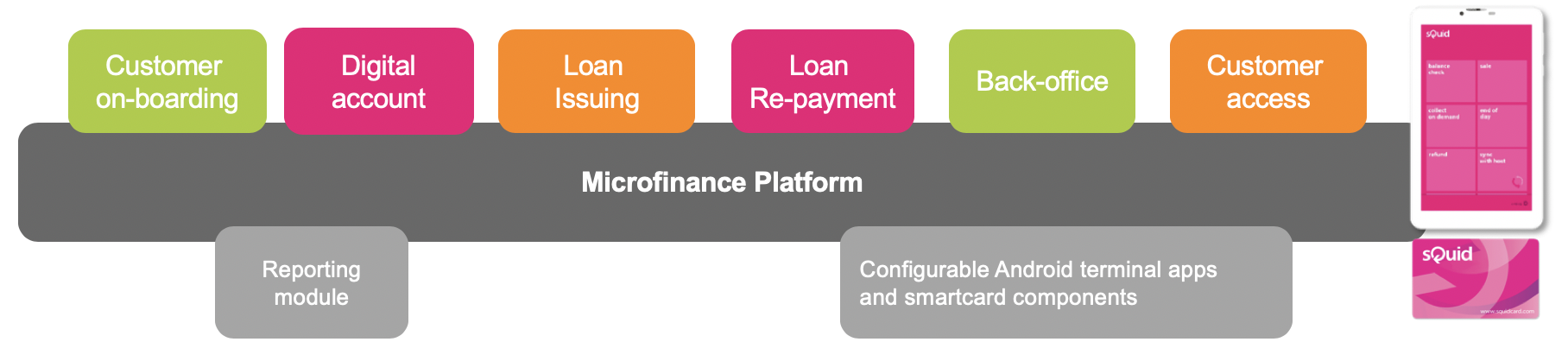

Key platform components

sQuid Microfinance platform

End-to-end microfinance system

sQuid’s modular system for microfinance is built on our own experience of running large scale financial distribution programmes in Africa.

Private cloud-based platform

sQuid’s microfinance platform operates on private servers, providing a highly-resilient service and enhanced security when compared to public cloud-based systems.

Platform features

- Customer onboarding mobile application - captures customer details including name, photo and ID.

- Customisable loan and savings products - multiple loan and deposit products for end-customers.

- Digital field applications - flexible on and off-line features enable efficient business processes in the user environment.

- Customer applications and portals - intuitive consumer-facing portals and self-management features.

- SMS messaging - customisable messaging to keep end-customers up to date with account activity.

- Fast data powered analytics - powerful data analytics dashboards provide insightful management information in real-time