Business from a different point of view

A digital transaction platform serving hundreds of thousands of users across the UK and Africa

Technology

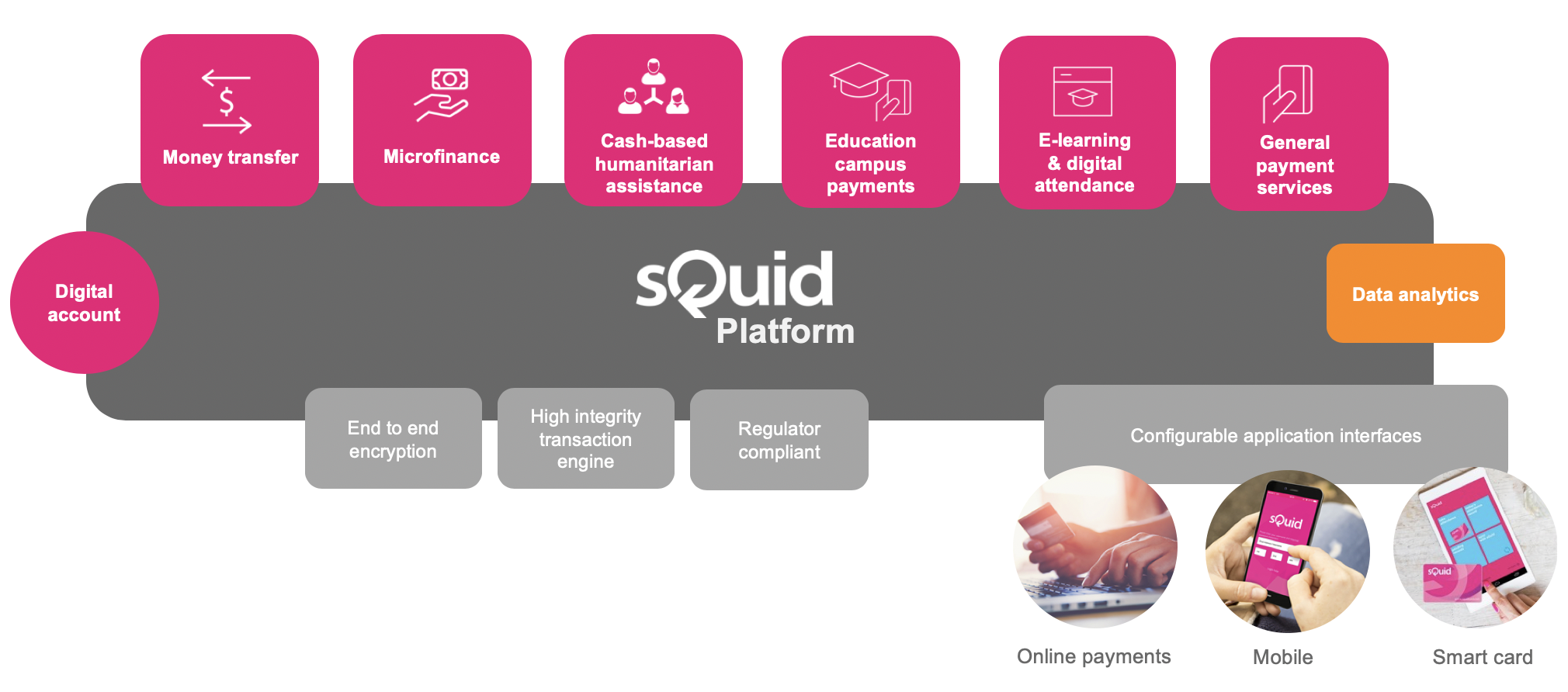

sQuid is a multi-use transactional platform providing payment, e-learning and attendance solutions for businesses, education institutions, governments, and non-governmental organisations.

Digital Transaction Processing

We build our own platforms, and have developed secure encrypted processes that deliver thousands of transactions every day.

sQuid’s core system

A powerful and sophisticated enterprise application that sits at the heart of our global payment and data transaction system - the core manages all interactions between the customers, merchants and wider-banking system.

Payment platform

Our secure, reliable and scalable eMoney payment platform is compliant with PCI-DSS Version 3.1, the highest level of PCI compliance. The platform integrates with multiple front-end web applications and processes, reconciles and settles millions of transactions every month.

Data platform

The sQuid data platform and accompanying technology captures and creates digital data profiles for individuals, enabling real-time reporting, sophisticated data mining capabilities and advanced analytics.

Web-based applications

We have developed a range of intuitive web applications for our clients and their end-users. These are used to manage client and end-user accounts, and we also build bespoke applications if required.

Mobile applications

We understand that the technological landscape has changed; that our users are much more likely to access their customer account using their smartphone. That’s why we developed our own mobile App, to ensure that our customers were able to access their account anywhere, at any time.

NFC-enabled tablets

We upgraded and evolved our reliable, tried & tested merchant terminals to our new Android based EPoS system that uses a bespoke tablet. We made this move to cater for our growing number of Humanitarian Aid & Development clients, and for our increasing activity in Africa.

Contactless cards & other identifiers

Our eMoney application can be added to contactless smart cards that feature sophisticated multi-wallet functionality. Other identifiers, such as biometric or wristbands can also be used.

Financial regulation

As an eMoney issuer, we comply with national regulator's requirements for payment systems and operate within the conditions set out by each nation's regulator in compliance with its Provision of Information requirements and anti-money laundering regulations.

Integration

Integrating with our technology is easy.

We provide our sQuid application programming interface (API) and develop against several API’s as well to provide a better solution for our clients. We also work with major equipment and service suppliers to deliver our fast, flexible and secure payment solution.

![Nationwide logo].jpg](https://www.squidcard.com/application/files/6914/4534/7111/Nationwide_logo.jpg)

Africa

We see the potential in Africa; we understand the local environment

It’s a market with the potential for exceptional growth in the immediate future, so we’re continuing to build upon our capacity to better service our clients and attract new business.

Our dedication to this region extends further than just partnering with organisations to deliver specific humanitarian aid programmes. We operate a dedicated, knowledgeable office and team based in Nairobi, Kenya, to oversee our African operations - who also manage the on-the-ground efforts for the iMlango programme.

Reflections on the Transforming Education Summit in New York

Three months ago, we were privileged to attend the Transforming Education Pre Summit in Paris; a prelude to last week’s big event in New York. We were excited and honoured to share thinking with so many like-minded individuals – all unified by a passion to ensure that every child around the globe has access to...

28 September 2022

sQuid features in the Sunday Times of Zambia

Education is a basic human right recognized globally and documented in many education policies, even among sub-Saharan African countries, Zambia inclusive. Education must therefore be available to all people to enable them explore their maximum potential. After many years of...

21 August 2022

Contact us now to find out more

Click on the button below to get in touch.